What Explains the Difference Between Retail and Commercial Banking

Central banks do not deal with customers directly. What explains the difference between retail and commercial banking.

Bank Of America Corporate Hierarchy Bank Of America Corporate Civil Engineering Jobs

According to the US.

. On the other hand wholesale banks specialize in the provision of services in large operations generally with large companies and. What Explains The Difference Between Retail And Commercial Banking. Whenever someone hears the word bank what comes to mind of most of the common people is the commercial banks.

Business loans are available to small businesses from commercial banks while business loans from retail banks are available to large companies. Commercial banks and central bank are important parts of the countrys overall economy. Retail Banking is a banking service provided to the general public or individual.

A bank can offer different products and services for both types of customers. According to Investorpedia retail banks are banks devoted to provide services to particular savers and investors and small and medium sized enterprises. Let us look at some of the points of difference between the central bank and commercial banks.

Retail banks loan money to small businesses while commercial banks loan money to large corporations. Central Bank vs Commercial Bank. Commercial banking services include checking and savings accounts.

Investment bank offers customer specific service whereas commercial bank offers standardized services. Up to 256 cash back A Commercial banks loan money to small businesses while retail banks loan money to large corporations. Differences between a retail bank and an investment bank.

The role of a commercial bank resembles a financier. Retail banking consists of banking that is offered to individuals where commercial banking is banking offered to commercial entities like corporations partnerships and sole proprietorships. Commercial banking on the other hand serves big businesses international corporation and other banks.

Often these can be multi banked at some level. Loan extended by the commercial bank is debt-related. Commercial banks on the other hand are those banks that help in the flow of money in an economy by providing deposit and credit facilities.

Commercial banks and Investment banks. Commercial banking on the other hand serves big businesses international corporation and other banks. Commercial banks offer a wide range of banking products and services to individuals and businesses.

Retail banking is geared towards serving individuals or small businesses. Difference Between Commercial Bank vs Investment Bank Depending upon the type of work performed by a bank they are generally divided into two major classes. Corporate banking is a commercial banking facility which only deals with small or large companies and corporate.

Commercial banking salaries vary greatly depending on the position in question. Retail bank accounts are different from commercial bank accounts. Commercial Bank is a bank established to provide banking services to the general public.

Also known as consumer banking or personal banking retail banking is the visible. In contrast a Commercial bank makes loans that enable the business to grow and hire people who contribute to the companys expansion. Fairly simple needs but more complex than a retail client as there is a need to manage working capital and the like.

Retail banking services include savings and transactional accounts mortgage and personal loans debit and credit cards. With commercial banking businesses can acquire the financing they need to expand generating additional employment. The main difference between Retail Banking and Commercial banking is that a Retail bank refers to a division within a bank that handles retail customers.

Retail banking refers to the division of a bank that deals directly with retail customers. Retail banking is banking at an individual and small level such as checking accounts personal loans savings accounts debit cards credit cards contracts and certificates of deposit. Unlike equity related loans are granted by the merchant banks.

The customer base of a commercial bank is comparatively higher than an investment bank. Retail banking is geared towards serving individuals or small businesses. Retail banking is the visible face of banking to the general public while corporate banking refers to the aspect of banking that deals with corporate customers.

Commercial banks help small businesses make capital purchases while retail banks help big. Commercial banks are less prone to risk while merchant banks are highly exposed to risk. On the contrary the merchant banks act as a financial advisor.

Retail banks loan money to small businesses while commercial banks loan money to large corporations. What explains the difference between retail and commercial banking. Customers deposits made by retail banks largely support lending to retail customers and businesses.

Commercial Banking is larger scale has more complex needs generally and often use a more complex supply chain so some for of trade finance is required. Bureau of Labor Statistics BLS the median pay for a bank teller in 2020 the most recently. Retail banking is designed to meet the banking needs of individuals of various degrees of wealth while commercial banking is offered to commercial enterprises of varying size.

Bank deposits help the nations economy by. Commercial banks loan money to small businesses while retail banks loan money to large corporations. Retail banking services include savings and transactional accounts mortgage and personal loans debit and credit cards.

The difference between retail and commercial banking is Retail banks loan money to small businesses while commercial banks loan money to large corporations. Where retail banking offers products to individuals for personal use commercial banking offers its products to institutions for institutional and corporate use. Commercial banks are the banks that serve customers directly.

Commercial banks provide financial services to the individuals and businesses.

Studio Visit At Other Stories Office Design Commercial Interiors Design

Commercial Bank What You Need To Know About Commercial Banks

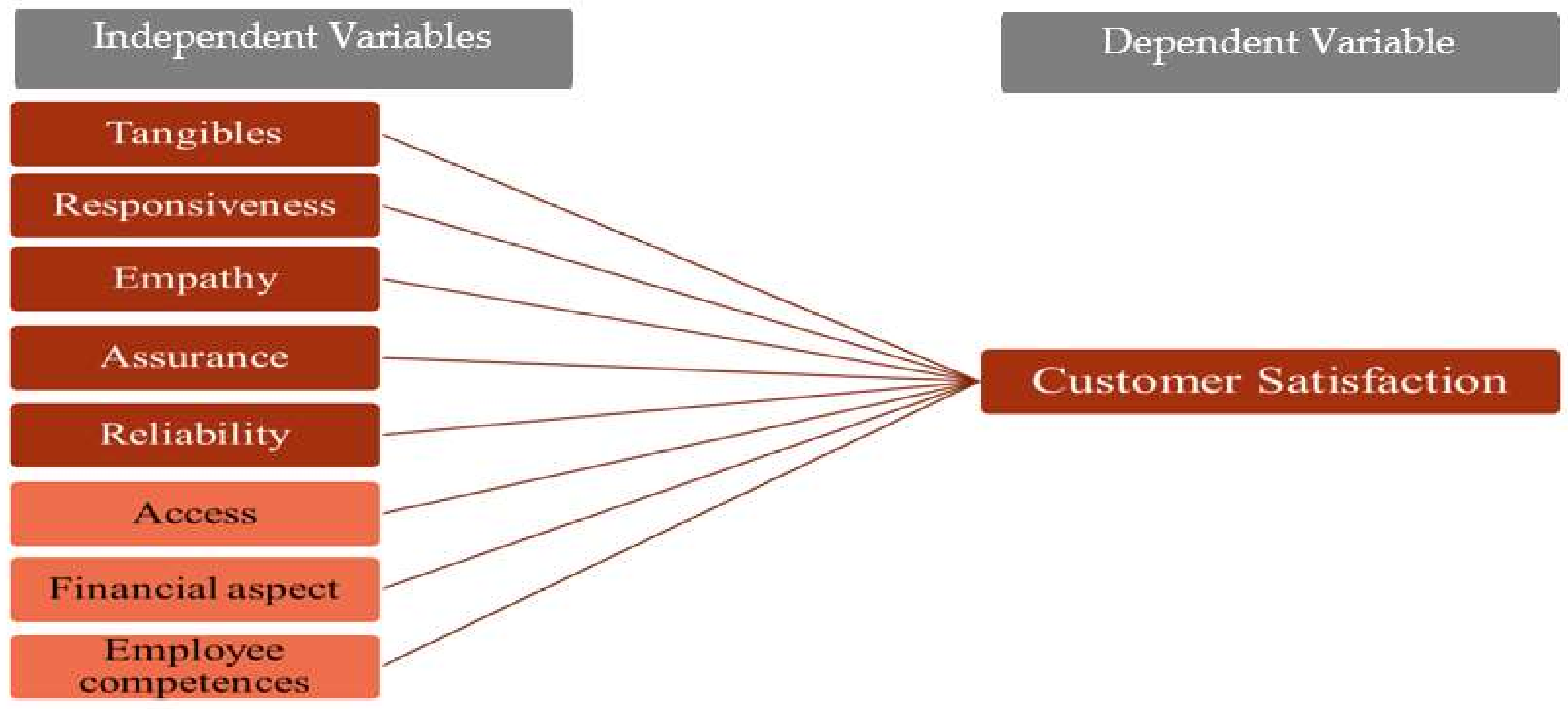

Sustainability Free Full Text The Service Quality Dimensions That Affect Customer Satisfaction In The Jordanian Banking Sector Html

What Are Commercial Banks Youtube

Business Hierarchy Google Search Hierarchy Corporate Business Strategy

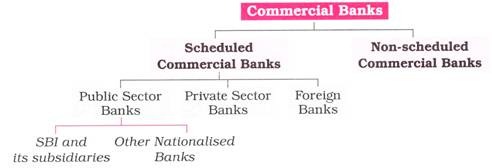

Commercial Bank Definition Function Credit Creation And Significances

21 Advantages And Disadvantages Of Commercial Banks Googlesir

Types Of Banks Banking Youtube Financial Institutions Finance Bank Underwriting

Loan Application And Processing Flowchart The Flowchart Explains The Application And Proce Process Flow Chart Flow Chart Template Process Flow Chart Template

New Commercial Building Commercial Construction Retail Architecture Building

As You Seek To Grow Your Independent Pharmacy You May Find That Local Banks Fall Within Your Geographical Zone However Financing F Local Banks Bank Live Oak

Pin By Hamad Alwazzan On Hamad Alwazzan Real Estate Usa Business Man Investment Banking

This Explains The Difference Between Notepad Wordpad And Microsoft Word And Simple Words Windows Programs Words

Construction Factoring Good Ole Days Invoice Factoring Is Not Complicated Watch This Quick Video That Expl Construction Finance Finance Financial Decisions

Trainee Banking Assistant At Dfcc Bank Career First Banking Banking Services Bank Jobs

65 Of Retailers Will Offer Same Day Delivery By 2019 Infographic Strategy Infographic Ecommerce Infographic Business Infographic

Retail Business Hierarchy Hierarchy Retail Business Process

A Commercial Bank Is A Type Of Financial Institution That Accepts Deposits Offers Checking Account Servi Commercial Bank Business Loans Certificate Of Deposit

Comments

Post a Comment